India’s AI Rebellion: The $500B Bet Silicon Valley Didn’t See Coming

Here’s a paradox that should keep Silicon Valley up at night: While nine of the top AI company founders in America are Indian immigrants, back home in Bengaluru and Mumbai, a parallel revolution is unfolding that nobody’s talking about.

And it’s not playing by Silicon Valley’s rules.

While OpenAI burned through $100 million to train GPT-4, a startup in Bengaluru built a competitive model for under $6 million. While ChatGPT struggled to understand a Hinglish request mixing English and Hindi, Indian AI models were already conversing fluently in 22 languages, including handling the linguistic chaos of “Aaj meeting cancel kar do yaar.”

This isn’t your typical underdog story. This is a calculated insurgency.

Why Silicon Valley’s AI Playbook Fails in India (And Why That’s India’s Secret Weapon)

Let me ask you something: Have you ever tried to use ChatGPT to book a train ticket in Tamil while sitting in a village with spotty 2G connectivity?

No? Well, 800 million Indians have that exact problem.

This is where the Western AI giants hit a wall. Their models assume high bandwidth, English fluency, and Western behavior patterns. India’s AI pioneers saw this gap and built something radically different.

Take Sarvam AI, founded by the creators of AI4Bharat at IIT Madras. They built Sarvam-1, a 2-billion parameter model that achieves something remarkable: token fertility rates of just 1.4-2.1 across Indian languages. Translation? While GPT needs 4-8 tokens to process a single Hindi word, Sarvam does it with less than 2.

That’s not incremental improvement. That’s architectural rebellion.

Pratyush Kumar, Sarvam’s co-founder, told me their model outperforms Google’s Gemma-2-2B and Meta’s Llama-3.2-3B on Indian language tasks while running 4-6x faster. On translation benchmarks, Sarvam-1 scored 39.83 on Flores English-to-Indic translation, crushing Llama 3.1 8B’s 34.23—despite being four times smaller.

The kicker? They trained it on 2 trillion tokens of synthetic Indic data they generated themselves because, unlike English, high-quality training data for Indian languages simply doesn’t exist at scale.

The Krutrim Moment: When Ola’s Founder Bet $2,000 Crore on Indian AI Sovereignty

Bhavish Aggarwal doesn’t do things by halves.

The Ola founder looked at India’s AI landscape in 2022 and saw a dependency problem. Every Indian startup was building on top of American models, sending data abroad, and paying foreign cloud providers. So he founded Krutrim with a audacious goal: build India’s first full-stack AI company, from chips to models to applications.

Within 18 months, Krutrim became India’s first AI unicorn at a $1 billion valuation, despite raising exactly zero venture capital.

Their flagship assistant, Kruti, isn’t trying to be ChatGPT. It’s trying to be your digital everything. Book a cab in Kannada? Done. Pay your electricity bill in Gujarati? Done. Order food in Hinglish? Done. Kruti processes voice commands in 13 Indian languages and integrates directly with India-specific services like UPI payments and local food delivery.

But here’s where it gets interesting: Krutrim isn’t just building software. They’re manufacturing India’s first AI chips—the Bodhi series designed specifically for frontier LLMs and autonomous systems. Aggarwal committed ₹10,000 crore ($1.2 billion) to build chip fabrication capacity by next year.

Why? Because he watched the DeepSeek moment unfold. When China’s DeepSeek trained a GPT-4 level model for under $6 million using “inferior” H800 chips, it shattered the myth that only billion-dollar budgets could build competitive AI.

Aggarwal saw the future: sovereign AI stacks, built on domestic chips, trained on local data, deployed on Indian cloud infrastructure.

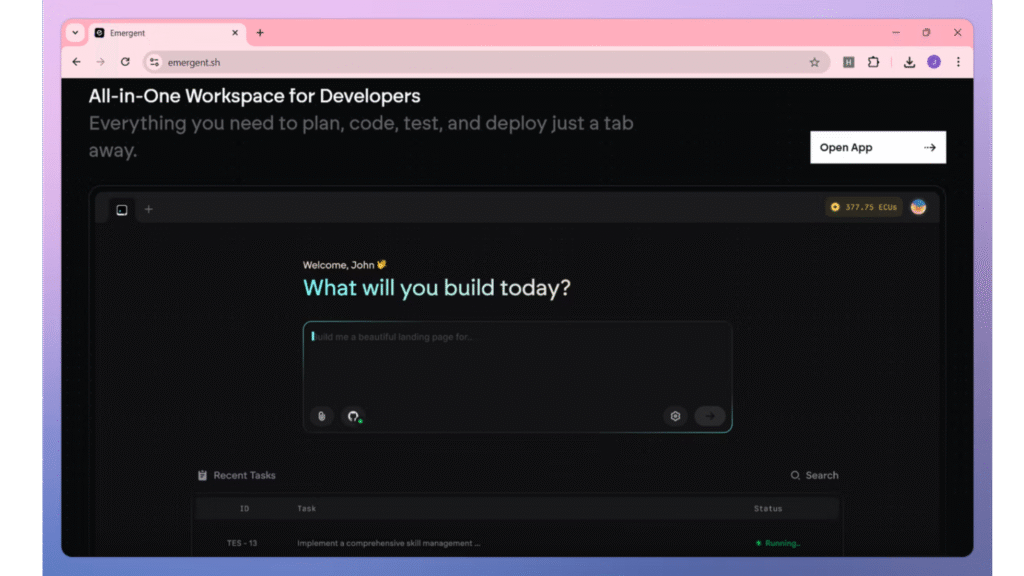

The Emergent Phenomenon: $15M ARR in 90 Days

While you were reading that last section, somewhere in Bengaluru, someone just built and deployed a full-stack application without writing a single line of code.

Welcome to Emergent AI, founded by brothers Mukund and Madhav Jha. Their “vibe-coding” platform lets anyone describe an app in plain language, and their AI agents design, code, deploy, and debug it automatically.

The numbers are almost absurd: 1.5 million apps built by 1 million users across 180 countries in just 90 days. That’s $15 million in annual recurring revenue, making Emergent the fastest-growing AI startup in Indian history.

A Michigan jewelry chain owner built an app to price repairs across 50 stores. A UK entrepreneur launched an EV marketplace. Neither could code.

Mukund calls it “agentic vibe-coding,” where intention—not syntax—is the entry barrier. The platform even manages API keys and backend infrastructure, so apps stay live without developer intervention.

They raised $23 million from Lightspeed India at a $90 million valuation. Not bad for a company that didn’t exist a year ago.

Fractal’s Quiet Dominance: The AI Unicorn You’ve Never Heard Of

Here’s a name that should be on every investor’s radar: Fractal Analytics.

Founded in 2000 in Mumbai, Fractal became an AI unicorn in 2022 after raising $360 million from TPG at a valuation exceeding $1 billion. They serve Fortune 500 companies across CPG, insurance, healthcare, and financial services with enterprise AI solutions.

What makes Fractal different? They’re not building chatbots. They’re deploying AI at the deepest layers of enterprise operations. Forrester Research named them a “Leader” in Customer Analytics Services in 2025, noting that enterprises looking for “top-of-the-line personalization and AI-powered next best experience” should consider Fractal.

Their secret sauce? A neuroscience-based approach to customer insights, integrated with engineering and design thinking. One Forrester reference client said: “My team gets to see what great looks like.”

Fractal partners with OpenAI, NVIDIA, AWS, and Microsoft Azure, but they’re not just reselling Western tech. They’re building proprietary AI platforms like Asper.ai for interconnected enterprise decisions and Flyfish, a GenAI platform for search and product discovery.

They’ve also incubated Qure.ai, a healthcare AI company that’s screened over 5 million patients across 30+ countries for tuberculosis, lung cancer, and stroke detection. Qure.ai partners with AstraZeneca, Medtronic, and Merck, and their AI interprets chest X-rays and CT scans in seconds.

5,000 employees across 18 global locations. Zero media hype. Pure execution.

Yellow.ai: The Agentic AI Platform Powering 1,300+ Enterprises

Imagine reducing customer support tickets by 85% overnight. That’s not a hypothetical—that’s what Yellow.ai did for Lion Parcel, a logistics company in Indonesia.

Founded in 2016 by three friends frustrated with terrible customer service, Yellow.ai has become the leading agentic AI platform for enterprise automation. Their system doesn’t just answer questions—it takes autonomous actions across voice, chat, and email in 150+ languages.

Here’s what makes them dangerous: Yellow.ai built their platform on multi-LLM architecture, trained on 16 billion conversations annually. That means they can choose the best model for each task—Claude for coding, GPT-4 for reasoning, their proprietary DynamicNLP for multilingual understanding.

Their clients read like a who’s-who of global business: Randstad, UnionBank of Philippines, Sony India, AirAsia, and over 1,300 others across 85+ countries.

At Google I/O Connect India 2025, they showcased how their AI agents handle complex, multi-turn conversations that maintain context across languages and channels. An AirAsia employee in Manila can ask questions about company policies in Tagalog via WhatsApp and get instant, accurate responses—even in low-bandwidth areas.

Gartner recognized Yellow.ai as a “Challenger” in the 2023 Magic Quadrant for Enterprise Conversational AI Platforms. They’re gunning for the “Leader” quadrant next.

The Haptik-Reliance Bet: $100M on the Future of Conversational Commerce

When Reliance Jio acquired Haptik for $100 million in 2019, taking an 87% stake, it signaled something profound: India’s largest telecom operator saw conversational AI as mission-critical infrastructure.

Haptik, founded in 2013 by IIT Kharagpur graduates, pioneered conversational AI in India. They built the MyGov Corona Helpdesk chatbot on WhatsApp during the pandemic, which served over 50 million users with COVID-19 information in English and Hindi.

But the real innovation is their SDK—a plug-and-play technology that brands can integrate in under an hour with just 10 lines of code. It enables conversational commerce on any platform: mobile apps, websites, WhatsApp, Facebook Messenger.

Post-acquisition, Haptik has expanded into voice bots, multilingual support across 20+ Indian languages, and domain-specific AI assistants for banking, healthcare, and HR. They’ve processed over 50 million interactions across travel, entertainment, food, utilities, and healthcare.

Their tech stack powers critical government services, including a chatbot that provides conversational access to 1,400 government services for an unnamed state government.

CoRover’s Ask DISHA: How One Chatbot Handles 100,000 Queries Daily

Here’s a number that should make you pause: 100,000 daily queries with 90% accuracy.

That’s CoRover’s Ask DISHA chatbot, deployed by IRCTC (Indian Railways’ ticketing arm). With 85% positive feedback from users, Ask DISHA has fundamentally transformed how 1.4 billion Indians interact with the world’s largest railway network.

But CoRover isn’t stopping at trains. They built Ask Sarkar, featured by Prime Minister Narendra Modi, which provides conversational access to government schemes via text, audio, and video. They launched AskDoc.ai, the world’s first AI Doctor VideoBot for COVID-19 information, supporting multiple languages.

Their technology won the Frost & Sullivan Award and NASSCOM’s AI Game Changer Award. More importantly, they’ve partnered with Karnataka State Road Transport Corporation (KSRTC), Indraprastha Gas Limited, and multiple government bodies to deploy conversational AI at population scale.

CoRover recently launched BharatGPT, a sovereign LLM built specifically for Indian contexts. It supports 14+ Indian languages, works in low-bandwidth environments offline, and integrates speech-to-text, NLP, and text-to-speech in one tight loop.

Unlike Western LLMs trained on global data, BharatGPT was trained on India-specific conversational datasets—from banking and travel to government helpdesks. The team uses advanced preprocessing pipelines that handle WhatsApp-style messages, Hinglish, emojis, transliterated words, and broken grammar.

The InVideo Rocket Ship: From Web Editor to AI Video Giant

Remember when creating a professional video required expensive software, technical skills, and hours of editing?

Sanket Shah and Ankit Bhati looked at that friction and said: “What if you could just describe the video you want?”

That question led to InVideo, which has raised $52.5 million from Peak XV Partners (formerly Sequoia), Tiger Global, and Hummingbird. With 10+ million users across 190+ countries, InVideo has become one of the fastest-growing AI video platforms globally.

Their AI doesn’t just edit video—it creates it from scratch. Type a prompt like “Create a cinematic video of Sherpas climbing Everest at dawn,” and InVideo generates the script, adds scenes, includes voiceovers, and delivers a polished video in minutes.

The company hit ₹580 crore ($70 million) in revenue in just 16 months, according to founder Sanket Shah at a recent conference. That’s not a typo. They went from zero to $70 million in revenue faster than almost any SaaS company in history.

What makes InVideo’s AI special? It understands context. It knows that a “UGC ad for wireless earbuds” needs a different style than a “documentary about the first humans discovering fire.” It adjusts tone, pacing, visuals, and music automatically.

Competitors like Synthesia and Veed are watching nervously.

The IndiaAI Mission: ₹10,372 Crore Government Bet

In March 2024, the Indian government approved the IndiaAI Mission with an allocation of ₹10,371.92 crore ($1.25 billion) across seven core pillars:

- IndiaAI Compute: 18,000+ GPUs procured (12,896 Nvidia H100s, 1,480 H200s) for startups and researchers

- IndiaAI Innovation Centre: Developing India’s sovereign foundational models

- IndiaAI Datasets Platform: Building 2 trillion tokens of Indic training data

- IndiaAI Application Development: AI solutions for healthcare, agriculture, climate

- IndiaAI FutureSkills: Training 500,000 people in AI by 2026

- IndiaAI Startup Financing: Supporting 10 startups expanding to Europe via Station F

- IndiaAI Safe & Trusted AI: Ensuring responsible AI deployment

In April 2025, the government selected Sarvam AI to build India’s first homegrown sovereign LLM under the IndiaAI Mission. Fractal Analytics was chosen to build India’s first Large Reasoning Model (LRM).

This isn’t just policy theater. The government deployed AIRAWAT-PSAI, India’s biggest and fastest AI supercomputing machine, with 13,170 teraflops of peak performance at C-DAC, Pune. They’re scaling to 1,000 AI Petaflops of computing capacity.

Why does this matter? Because China proved that government backing + domestic talent + strategic focus = AI supremacy. India is following the playbook.

The Talent Paradox: Why India Keeps Winning

Here’s the uncomfortable truth for Silicon Valley: India has 416,000+ AI/ML professionals—the second-largest pool globally after the US. India’s AI skill penetration is 2.8x the global average.

But here’s what’s changing: those professionals are increasingly staying home.

The MacroPolo Global AI Talent Tracker shows that while nearly all Indian AI researchers left India in 2019, by 2022, almost 20% chose to stay. That number is growing.

Why?

Better opportunities. When Krutrim offers you the chance to build India’s first AI chip, or Sarvam invites you to train sovereign LLMs, or Emergent lets you pioneer agentic coding—suddenly, that Silicon Valley job offer looks less compelling.

Lower costs, bigger impact. A senior AI engineer in Bengaluru earns $60,000-$80,000 versus $200,000+ in San Francisco. But your money goes 3x further, and you’re solving problems that affect a billion people, not optimizing ad clicks for a Bay Area startup.

Government support. The IndiaAI Mission is training 500,000 people in AI by 2026. MeitY is funding research centers, providing compute resources, and fast-tracking AI startups.

The result? A reverse brain drain is beginning. Indian-origin founders in Silicon Valley are launching India-first companies. Neetish Sarda (Smartworks’ founder) invested in Indian AI startups. Rajan Anandan (Sequoia’s MD) is backing India’s AI ecosystem aggressively.

The ChatGPT-UPI Integration: When OpenAI Picks India First

In October 2025, something unprecedented happened: OpenAI chose India as the launchpad for agentic commerce.

In partnership with Razorpay and NPCI (National Payments Corporation of India), OpenAI integrated UPI payments directly into ChatGPT. Users can now shop for groceries on BigBasket or recharge mobile plans on Vi by simply asking ChatGPT—and payments happen seamlessly via UPI without switching apps.

This isn’t just a payment feature. It’s OpenAI building the operating system for the real world, and they’re starting in India.

Why India? Because UPI processes 20+ billion transactions monthly—the world’s most trusted real-time payment network. Because 800 million Indians are already mobile-native and digital-first. Because India’s fintech infrastructure is more advanced than America’s.

Harshil Mathur, Razorpay’s CEO, calls it “agentic payments”—transforming AI assistants from discovery tools into full-fledged shopping agents.

While Silicon Valley debates the future of AI commerce, India is deploying it.

What Silicon Valley Gets Wrong About Indian AI

There’s a condescending narrative in Western tech circles: “India is great at services, but innovation happens elsewhere.”

That narrative is dying fast.

Here’s what Silicon Valley misses:

Indian AI companies are solving fundamentally harder problems. Building a chatbot for English-speaking Americans with unlimited bandwidth is easy. Building one that handles 22 languages, works offline, understands code-mixed speech, and runs on edge devices with 2GB RAM? That’s a different ballgame.

Cost efficiency is a feature, not a bug. When Sarvam trains a competitive model for $6 million instead of $100 million, that’s not corner-cutting—that’s engineering excellence. When CoRover’s BharatGPT works offline in low-bandwidth areas, that’s not a limitation workaround—that’s architecture for billions.

Sovereignty matters more than ever. After DeepSeek, after data localization laws, after geopolitical tensions—every country wants its own AI stack. India is building it faster than anyone expected.

The next trillion-dollar AI company won’t look like OpenAI. It won’t burn billions on compute. It won’t ignore 80% of the world’s languages. It won’t require cutting-edge infrastructure to deploy.

It will look like Krutrim, Sarvam, or Emergent.

The Real Numbers: Indian AI’s Explosive Growth

Let’s talk metrics:

- Funding: Indian GenAI startups raised $990M by H1 2025, up 30% YoY

- Startups: 100+ GenAI startups operational, with 1,750+ active GCCs (Global Capability Centers)

- Market size: India’s AI market projected to reach $17 billion by 2027 (NASSCOM)

- Unicorns: Krutrim ($1B), Fractal ($1B+), with more in pipeline

- Performance: Sarvam-1 outperforms models 4x its size on Indic benchmarks

- Adoption: 78% of Indian organizations reported using AI in 2024 (vs 55% in 2023)

- Research output: India ranks 10th globally for private sector AI investments (UN report)

- Talent: 1.9 million AI professionals, with AI services projected at $8B by 2025

But here’s the metric that matters most: Indian AI companies are achieving product-market fit faster than their Western counterparts.

Emergent hit $15M ARR in 90 days. InVideo reached $70M revenue in 16 months. Yellow.ai serves 1,300+ enterprises across 85 countries. CoRover handles 100,000 daily queries at 90% accuracy.

These aren’t science experiments. These are revenue-generating, customer-serving, problem-solving businesses.

The Geopolitical Chess Game: Why Everyone Wants Indian AI Talent

Here’s a question that should concern policymakers everywhere: What happens when India decides to nationalize its AI talent?

Indian-origin founders created 60% of top US AI companies. Indian engineers power Google, Microsoft, OpenAI, Anthropic. Indian researchers publish breakthrough papers at Stanford, MIT, CMU.

But as US immigration policies tighten—H-1B visa caps, green card backlogs, nationalist rhetoric—those professionals are reconsidering.

China demonstrated the playbook: offer incentives, build infrastructure, create opportunities, and talent returns. India is copying it.

Microsoft committed $3 billion to India’s AI ecosystem. Google is training millions through skill programs. Nvidia is building AI infrastructure in India. They see the writing on the wall: if they don’t invest in India, they’ll lose access to Indian talent.

The Carnegie Endowment for International Peace published a paper titled “The Missing Pieces in India’s AI Puzzle: Talent, Data, and R&D.” The thesis? India has the raw materials for AI leadership—it just needs strategic focus.

That focus is arriving. Fast.

The DeepSeek Lesson: Why Efficiency Beats Brute Force

When China’s DeepSeek opensourced a GPT-4-level model trained for under $6 million using “inferior” H800 chips (not the top-tier H100s), it sent shockwaves through Silicon Valley.

The prevailing narrative collapsed: You don’t need billions in funding, cutting-edge hardware, or unlimited compute to build competitive AI.

Indian AI founders noticed.

Krutrim’s Bhavish Aggarwal said: “DeepSeek proved that you don’t need billions to build a competent model. This fundamentally alters what is considered defensible in AI.”

Sarvam’s Pratyush Kumar echoed: “The DeepSeek moment affirmed our approach. Building AI models efficiently, locally, on Indian data—that’s the future.”

The lesson? Efficiency, optimization, and architectural innovation beat throwing money at problems.

Indian AI companies are architected for capital efficiency from inception. Fractal became a unicorn serving Fortune 500 clients with a fraction of Silicon Valley’s burn rates. Yellow.ai built a market-leading platform trained on 16B conversations without raising mega-rounds.

This isn’t just good business—it’s a competitive moat.

What’s Next: The 2025-2030 Roadmap

Buckle up. Here’s what’s coming:

By end of 2025:

- Krutrim ships India’s first AI chips (Bodhi series)

- Sarvam deploys sovereign LLM across government institutions

- At least 3 more Indian AI unicorns emerge

- IndiaAI compute capacity hits 18,000+ GPUs

By 2027:

- India’s AI services market reaches $17 billion (NASSCOM projection)

- Indian AI companies IPO or get acquired at billion-dollar+ valuations

- India becomes Top 5 globally for AI patent filings

By 2030:

- India produces 10 million AI-trained professionals (Microsoft goal)

- Indian AI models achieve parity with Western counterparts on global benchmarks

- At least one Indian AI company reaches $10B+ valuation

By 2035:

- India establishes itself as a global leader in inclusive AI deployment

- Indian AI infrastructure serves Southeast Asia, Middle East, Africa markets

- India owns complete sovereign AI stack: chips, models, cloud, applications

Ambitious? Absolutely. Impossible? Not even close.

The Contrarian Take: Why Indian AI Might Fail (And How to Prevent It)

Let’s be honest about the risks:

Brain drain persists. Despite improvements, 80% of top Indian AI researchers still leave. One successful startup doesn’t reverse decades of migration patterns.

Funding gaps. US AI investment in 2024: $109.1 billion. China: $9.3 billion. India: Far less. Building AI requires sustained capital—India’s funding ecosystem isn’t there yet.

Infrastructure lag. While 18,000 GPUs sounds impressive, OpenAI reportedly uses hundreds of thousands. The compute gap is real.

Data quality. Yes, India is building Indic datasets, but Western models have 20+ years of accumulated, curated training data. Catching up takes time.

Execution risk. Government initiatives like IndiaAI Mission sound great on paper. Execution is hard. China’s AI ambitions succeeded because of ruthless efficiency—can India match that?

Global competition. Every country wants AI sovereignty now. India is competing with China, EU, Middle East, Southeast Asia—all with deeper pockets or strategic advantages.

How to mitigate these risks?

Retain talent aggressively. Make staying in India more attractive than leaving. That means competitive pay, world-class research facilities, and career growth.

Focus on differentiation, not parity. Don’t try to out-GPT OpenAI. Build models that solve uniquely Indian problems better than anyone else, then export that expertise.

Leverage diaspora strategically. Indian-origin founders in Silicon Valley are an asset, not a liability. Create partnership models that let them contribute to India’s ecosystem while staying global.

Accelerate execution. Government needs to move faster, fund more aggressively, and eliminate bureaucratic friction.

Build for global markets from day one. Krutrim, Sarvam, InVideo succeed because they’re global-first. India-only focus limits upside.

The Uncomfortable Question: Is India Building AI or Just Localizing Western Models?

Critics argue that Indian AI companies are just fine-tuning Western models for Indic languages—not building fundamentally new technology.

There’s some truth here. Many Indian startups do start by adapting Llama, GPT, or Claude. Yellow.ai’s multi-LLM approach relies on Western models for certain tasks.

But this critique misses three crucial points:

First, adaptation at India’s scale is innovation. Making AI work for 22 languages, low-bandwidth networks, voice-first interfaces, and edge devices isn’t trivial. It requires architectural changes, not just prompt engineering.

Second, companies are moving beyond adaptation. Sarvam built their translation model from scratch using Gemma as a foundation, not a crutch. Krutrim is designing custom chips. Fractal developed proprietary platforms. CoRover’s BharatGPT is trained on India-specific data.

Third, indigenous development is accelerating. Yes, India started by localizing. But the IndiaAI Mission explicitly funds sovereign LLM development. Sarvam was selected to build India’s foundational model. That’s not adaptation—that’s indigenous innovation.

The trajectory is clear: India starts by adapting, learns the playbook, then builds its own. That’s exactly how China, South Korea, and Taiwan became tech powers.

Why Indian AI Founders Are Returning Home

Here’s a trend worth watching: Indian-origin founders in Silicon Valley are increasingly launching India-first companies.

Why?

Market size. India has 800 million smartphone users, 900 million internet users, and a middle class growing faster than any country in history. The addressable market is staggering.

Infrastructure readiness. UPI processes 20B+ transactions monthly. Digital identity via Aadhaar covers 1.4 billion people. India’s digital public infrastructure is world-class.

Government support. IndiaAI Mission, startup incentives, GPU access—the government is rolling out the red carpet.

Cultural context. Solving India’s problems requires understanding India’s complexity. Who better than Indian founders?

Global ambition. Indian founders increasingly think globally from day one. InVideo serves 190+ countries. Yellow.ai operates in 85+ markets. These aren’t India-only plays.

Lower competition. In Silicon Valley, you’re competing with OpenAI, Anthropic, Google, Meta—all with billion-dollar war chests. In India, you’re pioneering.

The math is simple: Would you rather be the 47th LLM wrapper in San Francisco or the first sovereign AI stack builder in Bengaluru?

The Ultimate Prediction: An Indian AI Company Will Hit $100B Valuation by 2035

Let me make a bold prediction that will age like milk or wine:

By 2035, at least one Indian AI company will reach a $100 billion valuation.

Why I believe this:

Precedent. China went from zero to multiple $100B+ tech companies (Alibaba, Tencent, ByteDance) in 20 years. India’s trajectory is similar, just delayed.

Market size. India’s population (1.4B) + Southeast Asia (700M) + Middle East (400M) + Africa (1.4B) = 3.9 billion people who need AI that works for them. That’s bigger than China’s market.

Cost advantage. Indian AI companies build at 5-10% of Silicon Valley costs. That efficiency compounds into massive margins.

Government backing. ₹10,372 crore is just the start. As AI proves critical for economic growth, expect 10x more funding.

Talent density. 1.9 million AI professionals, growing rapidly, with retention improving.

Infrastructure. UPI, Aadhaar, Digital India stack provide a foundation Western startups lack.

Global ambition. Indian founders think globally from inception. They’re not building for India—they’re building from India.

The question isn’t if an Indian AI company hits $100B valuation. It’s who gets there first.

Your Move: How to Invest in (or Build) India’s AI Future

So what do you do with this information?

If you’re an investor:

- Look beyond the obvious names. Krutrim and Sarvam are known; dig deeper.

- Focus on companies solving uniquely hard problems: multilingual AI, low-bandwidth deployment, edge computing

- Favor companies with government partnerships and sovereign AI mandates

- Watch for exits: acquirers include Reliance, Tata, global tech giants

If you’re a founder:

- India-first strategy can work globally. Don’t limit yourself to local market.

- Solve for diversity and constraints; they’re your moat.

- Partner with IndiaAI Mission for compute and data access

- Build capital-efficiently; efficiency is a competitive advantage

If you’re an engineer:

- Consider staying in (or returning to) India. Opportunities are exploding.

- Work on sovereign AI projects; they’re nation-defining.

- Focus on Indic NLP, multilingual models, edge AI—these skills are rare

If you’re a policymaker:

- Accelerate IndiaAI Mission execution

- Create incentives for talent retention

- Build partnerships with diaspora

- Focus on areas where India can lead: multilingual AI, frugal AI, inclusive AI

The Final Word: This Is India’s Sputnik Moment

In 1957, the Soviet Union launched Sputnik. America panicked, mobilized, and landed on the moon 12 years later.

DeepSeek was India’s Sputnik moment.

When China demonstrated that competitive AI doesn’t require Silicon Valley’s resources, it shattered assumptions. Every country realized: We can do this too.

India is uniquely positioned. It has the talent, the market, the infrastructure, and increasingly, the will. What it needs is sustained focus and aggressive execution.

The next decade will determine whether India becomes an AI superpower or remains a footnote in tech history.

Here’s my bet: Ten years from now, we’ll look back at 2025 as the inflection point. The year Indian AI stopped being a curiosity and became a juggernaut.

The year founders like Bhavish Aggarwal, Pratyush Kumar, and Sanket Shah proved that world-class AI doesn’t require a Silicon Valley address.

The year India declared: We’re not just coding for the world. We’re building the future.

So here’s my question for you: When India produces its first $100B AI company, will you say you saw it coming? Or will you be scrambling to catch up?

The smart money is already moving. Where’s yours?

Drop a comment: Which Indian AI company do you think reaches unicorn status next? And which one hits $100B valuation first? Let’s debate.

Leave a Reply